Every deed of conveyance, assignment or transfer of real property to a company or other entity is subject to 10% VAT. Acquisition of a first home by a Bahamian citizen; 4% where the value exceeds $300,000 but does not exceed $500,000.

In The Bahamas, property sellers are responsible for paying the real estate commission, which is set at 10% for undeveloped property and 6% for developed property, whether residential or commercial. Stamp duty on mortgages is 1% of the borrowed amount, while legal fees for property conveyance are negotiable, starting at 1.5%, plus additional out-of-pocket expenses.

Foreign purchasers may have their lawyer apply for a Certificate of Investment from the Bahamian Investments Board. Non-Bahamians who own a home in the Bahamas may also apply for an annual homeowner’s resident card, which allows the owner and immediate family to enter and remain in the country.

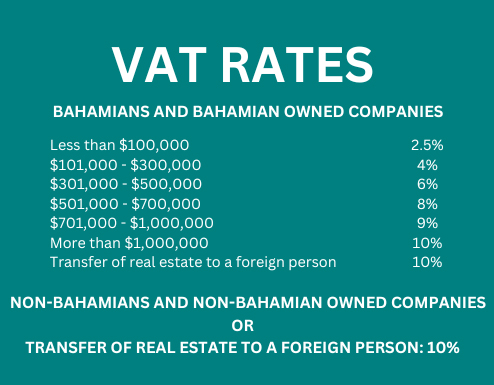

Value Added Tax (VAT) is charged on all property transactions. For foreigners, the rate of 10%, is split between the vendor and the purchaser. VAT is also charged on commissions, legal fees, appraisals, and Common Area Maintenance (CAM) charges. For Bahamian buyers, there is a sliding VAT scale and first-time homeowners may apply for an exemption on VAT for conveyance and mortgage instruments, up to triplex residences.