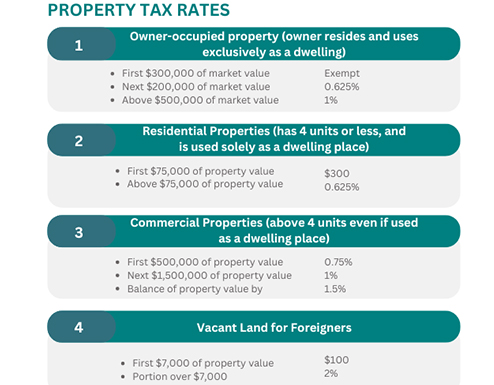

Real property taxes are assessed on all real estate in the Bahamas; unless the specific property is exempt by statute or otherwise. All real property must be declared at the Department of Inland Revenue. Owners can initiate an assessment for property tax by completing and submitting a Property Tax Application form to the Real Property Tax (RPT) valuation unit. Owners need to provide documents such as the Deed of Ownership, property conveyance or a current appraisal. A qualified Bahamian Appraiser can assist, and there is a dispute mechanism in place to ensure fair evaluation of taxes owed.

Starting January 2023, there is a ceiling of owner-occupied tax of $120,000 and high-end properties participating in a hotel rental pool will be subject to a condo-hotel tax at 75% of the residential rate. Although rare, the Bahamian Treasurer has the authority to sell unimproved vacant land if real property taxes remain in arrears and unpaid for at least 6 months after a 30-day expiration from when they became due.