The UAE’s progressive regulatory clarity on tokenized real-world assets (RWAs), specifically its recent landmark decision that tokenized RWAs are not securities unless the underlying asset itself qualifies as a security – presents a compelling model for adoption in the U.S., Canada, and The Bahamas.

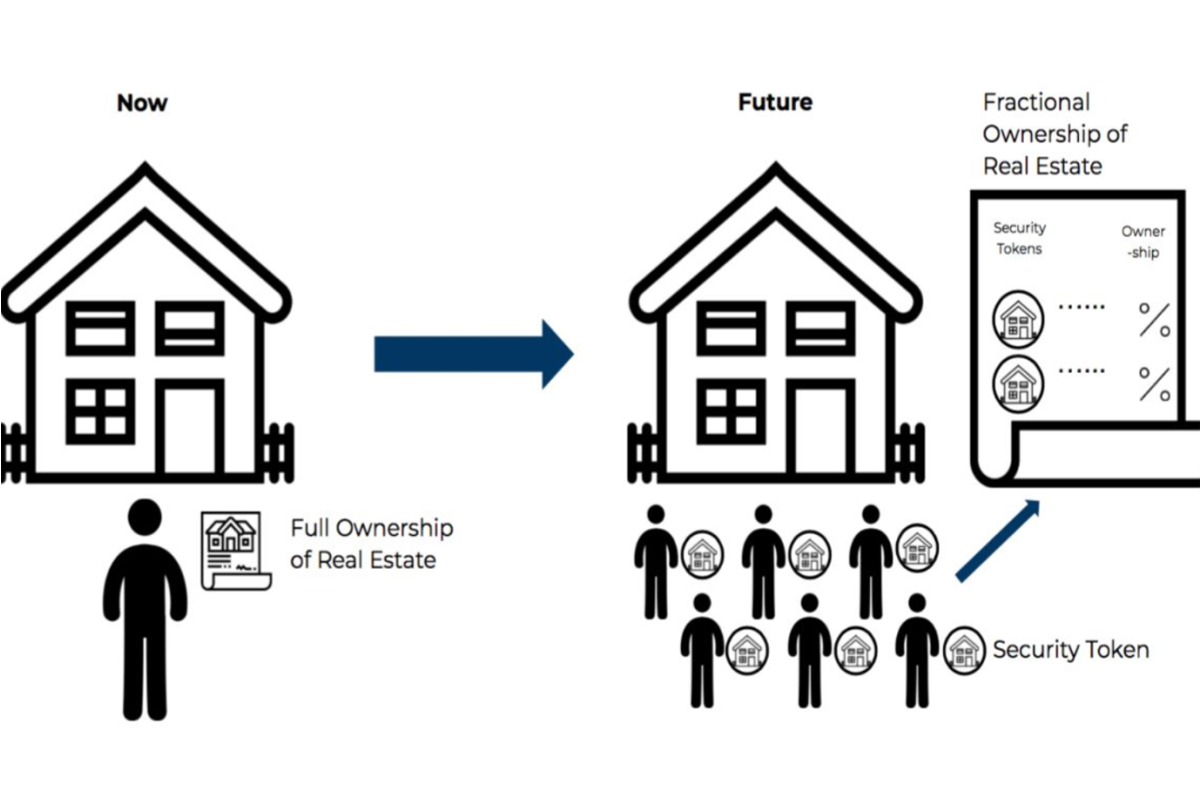

By implementing similar frameworks, these jurisdictions could unlock significant investment potential in real estate tokenization while maintaining appropriate safeguards.

Dubai’s Securities and Commodities Authority (SCA) approach balances innovation with investor protection, providing much-needed legal certainty for asset-backed digital securities. Given the growing demand for fractional ownership and blockchain-based real estate transactions, North American and Caribbean regulators should prioritize replicating this distinction to foster responsible growth in digital asset markets. This would position major real estate hubs like Miami, Toronto, and Nassau at the forefront of Web3 property innovation while attracting institutional capital through clear compliance pathways.

#DevelopLuxuryBahamas #IslandTokenization #LiveWhereOthersVacation #LuxuryIsland

Explore how tokenization could transform real estate development:

rbrown(at)bhhsb(dotted)com / Cell & WhatsApp: (242) 376 1249